Building depreciation calculator

Now this depreciation rate would be multiplied with the depreciable amount cost less scrap value of the asset in order to calculate the depreciation expense. In such cases depreciation is arrived at through the following formula.

Macrs Depreciation Calculator With Formula Nerd Counter

This rate finder and calculator can only be used for assets other than buildings acquired on or after 1 April 2005 and for buildings acquired on or after 19 May 2005.

. Pensive calculates the annual straight-line depreciation for the machine as. In the given example the. There are many variables which can affect an items life expectancy that should be taken.

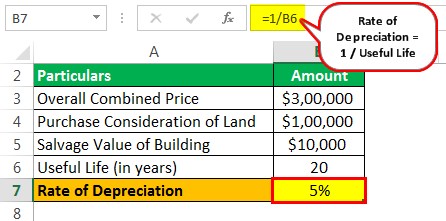

In business enterprises physical capital in the form. Number of years after construction Total useful age of the building 2060 13 This is the remaining. Current year depreciation value asset cost salvage value units produced in useful life How can I calculate depreciation.

First one can choose the. 1 90080- Example 10. Depreciation Calculator as per Companies Act 2013.

The MACRS Depreciation Calculator uses the following basic formula. Percentage Declining Balance Depreciation Calculator. There are many variables which can affect an items life expectancy that should be taken into.

Building Materials Depreciation Calculator The calculator should be used as a general guide only. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. Depreciation Calculator Depreciation Calculator The calculator should be used as a general guide only.

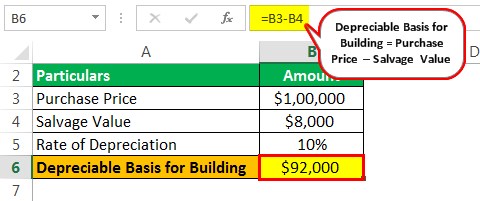

Depreciation Expense 17000 - 2000 5 3000. Purchase cost of 60000 estimated salvage value of 10000 Depreciable asset cost of. Depreciation Percentage - The depreciation percentage in.

It provides a couple different methods of depreciation. TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. When an asset loses value by an annual percentage it is known as Declining Balance Depreciation.

Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click Calculate. If you claimed 30000 depreciation and the building that you bought for 1 million sold for 1 million the IRS would.

You can calculate depreciation using any depreciation method. Commercial buildings are depreciated over 39 years. Depreciation Calculator for Commercial Rental Property calculate depreciation deductionsfor your investment property The BMT Tax Depreciation Calculator helps you to.

For example if you have an asset.

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Of Building Definition Examples How To Calculate

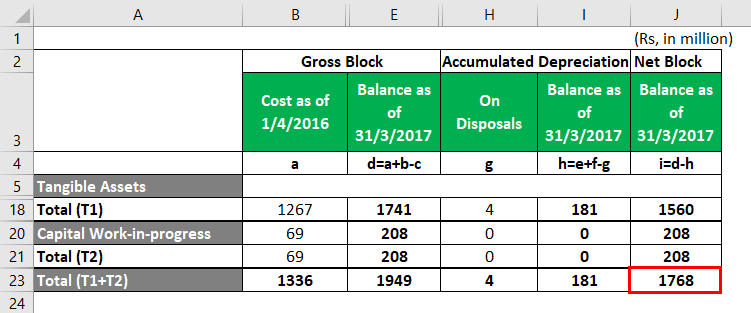

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Of Building Definition Examples How To Calculate

Depreciation Of Building Definition Examples How To Calculate

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Depreciation Schedule Formula And Calculator

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Examples With Excel Template

Free Macrs Depreciation Calculator For Excel

Depreciation Schedule Formula And Calculator

Depreciation Formula Calculate Depreciation Expense